Protection against Zombie companies

So what is a “zombie company”?

A “zombie company”, broadly speaking, is a term used by the media to describe a business which is trading off bank loans or finance agreements. These company are able to operate and service their debt, due to the interest levels being at a record low. On the face of it, these business seems liquid, however as interest rates rise, these companies in turn will struggle to meet payments and could potentially fold.

A “zombie company”, broadly speaking, is a term used by the media to describe a business which is trading off bank loans or finance agreements. These company are able to operate and service their debt, due to the interest levels being at a record low. On the face of it, these business seems liquid, however as interest rates rise, these companies in turn will struggle to meet payments and could potentially fold.

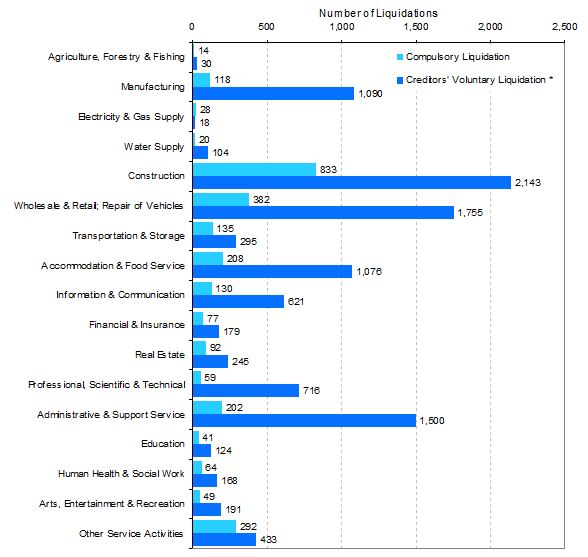

Latest figures released from the Insolvency Service show a drop in business insolvencies over Q4, 2013. These figures are a positive sign that the economy is inching closer to recover. Waters & Gate noticed on analysing these figures more closely, there are still significant levels of business insolvency with large variations in the levels by industry sector.

So what credit management techniques can companies use to protect themselves?

Waters & Gate recommend monitoring a number of areas in order to ensure that businesses protect themselves against the threat of bad debt due to a “zombie company”. As best practice, Waters & Gate would recommend these precautions are integrated into any robust credit management process.

- Credit check both a business and the directors thoroughly

- Use credit risk monitoring tools to constantly monitor the credit worthiness of a business

- Know your customer including their payment trends, liquidity and industry sector

- Ensure your customer sticks to your payment terms and react quickly should payments become late

There is no one magic formulate to protect your business against the threat of bad debt. Waters & Gate recommend that all staff responsible for credit are well trained and have the right tools to monitor the clients you are trading with. On-going investment in credit management will have a significant financial benefit in the reduction of bad debt in the long term.

For free advice on any of the issues raised in this article please call Waters & Gate the credit management and debt recovery specialists, 02921 262 130